The definitive list:

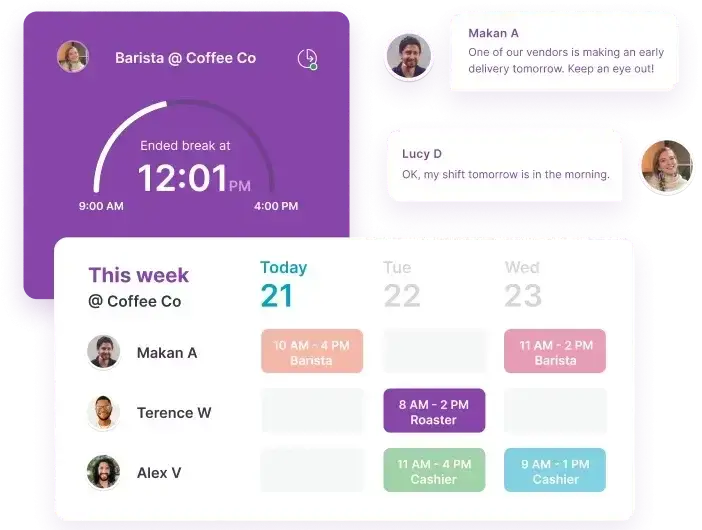

- Geolocation

- Online Kiosk

- Project Time Tracker

- Payroll Hours Tracker

- Customizable leave types

- Employee Vacation Tracker

- Integration with biometric devices

- Accessible on mobile and desktop

- 100% free

- Excellent customer support

- Detailed and accurate reporting

- Simple to set up and easy to use

- Facial recognition and GPS tracking

- May cause sudden boosts in productivity and unexpected accomplishments!

Jibble offers an affordable and customizable time tracking solution that even top companies like Tesla and Pizza Hut use.

The software is equipped with facial recognition and GPS tracking features, ensuring accurate attendance records. Plus employees can clock in from various platforms, including the mobile app, web, Slack, MS Teams, or a shared tablet. This provides next-level flexibility and convenience for all industries.

In Ohio, the current minimum wage is $10.45 an hour. However, this rate only applies to businesses that make over $342,000 in yearly sales. To help comply with the minimum wage laws applicable to your business, Jibble lets employers customize pay rates for each employee.

There are also overtime rules in the app that covers Daily Overtime, Daily Double Overtime, Weekly Overtime, Rest Day Overtime, and Public Holiday Overtime. And although Ohio doesn’t have regulations about rest days and public holiday overtime you can set overtime rates according to your company policies.

As for PTOs and leaves, employees can send in their requests within the app. Employers can set different leave policies to comply with state required leaves including Family and Medical Leave, Jury Duty Leave, and Voting Time Leave.

With Jibble, you can trust that your time-tracking data is always up-to-date and accurate, empowering you to make informed decisions for your business. Plus, Jibble is 100% free, offering all these powerful features without any extra costs.

- Point of sale integration

- Time clock app with timesheets

- Employee shift scheduling system

- Employee data management system

- Easy-to-use time clock

- Effortless payroll system

- Various clock-in methods

- Team messaging and group chat feature

- Highly reliable schedule creation system

- Extra fees for basic features

- Insufficient reporting feature

- Inconsistent scheduling feature

- Clock-in glitch in the mobile app

Homebase is a powerful time-tracking software that offers numerous benefits to Ohio businesses striving to comply with labor laws.

For a start, it helps ensure your business stays compliant by enabling overtime rules for your team. You can do this directly on the app’s settings. There’s even a drop-down where you can view the overtime requirements for your state. Overtime calculations are automatically done for you and can be seen on the Timesheets page.

Ohio doesn’t have any regulations regarding breaks. But if you have company break policies, you can add break rules and mark whether they are paid or unpaid, optional or mandatory. If the break is mandatory, you can turn on the break penalty feature for better compliance.

For payroll, you can add team members via the Team Roster. You can also set the hourly pay rates for your employees to match the required pay rates in the state. According to Ohio payment rules, payments are on or before the first day of the current calendar month for any work completed in the first 15 days. Using Homebase you can set your company’s pay schedule to comply with this directly from the Payroll dashboard.

The only payroll integration currently available on Homebase is QuickBooks. This will be an issue if you already use other payroll software in your company. The reporting feature could also use more work as some filters aren’t available to show only relevant data to you. But don’t get me wrong, it still makes for great time-tracking software for any business in Ohio!

- Mobile Access

- Pomodoro Timer

- Scheduling and Attendance

- Screen Activity Recording

- Projects and Task Management

- User-friendly interface

- Easy timesheet creation

- Remote employee monitoring

- Responsive customer support

- Accessibility and multi-platform support

- Limited reporting capabilities

- Lack of third-party integrations

- A steep learning curve for new users

- Glitches or performance issues with the mobile app

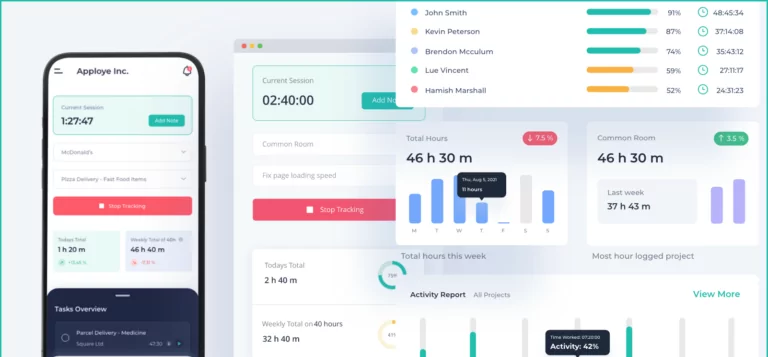

Apploye offers a suite of features, including efficient time tracking, employee management, project tracking, and activity monitoring. This makes it a suitable solution for growing businesses in Ohio.

This software can track employee hours in real-time or through manual logging, ensuring accurate payroll and client invoicing timekeeping. But Apploye does more than just time tracking. It gives employers a closer look at employee activity through its RemoteTrack feature. This records what apps employees use, which sites they visit, and how long they spend on each one. It may seem borderline stalking, but it’s completely legal in the state of Ohio as long as tracking is done during work hours.

Apploye also has a Pomodoro Timer feature. This can greatly come in handy when users want to set their work session duration and customize their break length. Admins can also set fixed breaks throughout the day to make compliance easier. It’s important to note that if the breaks you set are under 20 minutes, they should be paid at the same hourly rate. So make sure to set these breaks as billable time.

Regular pay and overtime rates can be set for each employee on the app. And at the end of every workday, you’ll see the total billing amount automatically calculated based on the pay rates you’ve set. This helps ensure every employee is paid their due, no more, no less.

But while Apploye excels in many areas, it falls short in detailed reporting and lacks critical third-party integrations and customization options. No payroll integrations are available within the app, so you’ll have to export your timesheet data manually to your payroll provider.

- Employee Scheduling

- Extensive time tracking

- PTO and leave management

- Mileage and expenses reports

- Integrated human resource system

- Easy to use

- Free version

- GPS time tracking

- Fully customizable supervisor settings

- Outdated UI

- Lack of integrations

- Substandard customer service

Timesheets.com is a web-based time-tracking software that offers various features to benefit businesses in Ohio. Small businesses can easily track employee work time and manage their operations through a user-friendly interface.

One of the key advantages of Timesheets.com for Ohio businesses is its customizable reporting options. Real-time employee activity is automatically reflected on the time cards. And you can generate reports covering expenses, project time, payroll, location, and attendance. These reports ensure you’re always ready with complete employee records if an audit comes knocking on your door.

There are several required and non-required leaves under Ohio’s leave laws. Thankfully, Timesheets.com allows you to customize accruable time off categories like sick and vacation and non-accruable time off types like holiday and jury duty. You can use any of the standard accrual rates like yearly, bimonthly, weekly, and even by-hours-worked to track employee leave time. You can also set a limit for all accruable time off categories so that time stops accruing at a preset limit.

To help manage employee overtime and comply with overtime laws, there are three available overtime parameters on Timesheets.com:

- None: Overtime is not calculated when closing payroll.

- Weekly Overtime: Used in most areas of the country. The default weekly threshold is 40 hours, but that value is adjustable.

- Daily Overtime: For those with daily reporting requirements.

On top of all this, the software also comes equipped with tools like GPS integration and IP locking, helping eliminate time theft. But I have to say, the downside with Timesheets.com is its outdated UI and lack of app integrations. Both of these are very important for a more convenient user experience.

- GPS tracking

- Productivity Analysis

- Vacation/Leave Tracking

- Customizable Templates

- Remote Monitoring & Management

- Job site and geolocation features

- Easy to schedule shifts for employees

- Screenshot and keystroke capture and monitoring

- Expensive pricing

- No advanced tracking

- Reporting lacks more detail

- Stopwatch requires a second app on the desktop

Hubstaff is a powerful time-tracking software offering a range of features to manage projects effectively. It allows employees to track time through its desktop app, web kiosk, or iOS and Android applications.

Time theft is a thing of the past, thanks to Hubstaff’s employee monitoring features. It takes random screenshots while employees are clocked in and monitor mouse and keyboard usage. There’s even a geolocation feature for on-site time tracking. But although legal in the state of Ohio, not all employees may be comfortable with this level of employee monitoring. If needed, managers may disable some of these features for each employee.

From the app dashboard, you’ll be able to see an overview of real-time employee activity, including what apps they used and sites they visited. The total hours worked plus the billable amount is also shown here.

Pay rates for each employee can be adjusted to meet Ohio’s minimum wage and exemptions. The same goes for overtime. All you need to do is add your overtime policies and the corresponding pay rate multiplier and weekly threshold. Managers and users will be notified via email once team members exceed the set threshold and go into overtime.

In addition to time tracking, Hubstaff provides detailed reports, client invoicing, and direct payment options based on customizable pay rates. The platform also seamlessly integrates with over 30 applications like Basecamp, Trello, and Paypal.

Hubstaff excels in tracking time for payroll, but its pricing may be a bit steep for smaller businesses. Additionally, users might encounter occasional bugs, and software crashes can impact productivity. Hubstaff’s Android app has received mixed reviews on the Google Play Store. That’s definitely something important to consider if your business needs a reliable time-tracking mobile app.

- Auto-scheduling

- Payroll integrations

- Employee break compliance

- Time tracking and real-time attendance

- Value for money

- Dynamic reporting

- Automates complex pay calculations

- Logging shifts through the mobile app

- Outdated user interface

- Complicated time tracking

- Lack of user-specific customizations

- Lack of functionalities in Android app

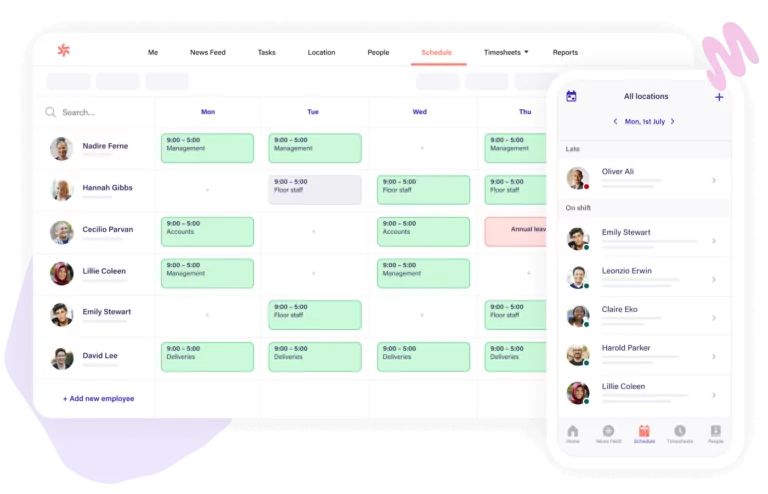

Deputy is another cloud-based time tracking and attendance app worth considering for Ohio businesses. With features like attendance tracking, overtime monitoring, and break compliance, Deputy simplifies employee management and ensures compliance with labor laws.

If you’re in retail or food service, you’ll be happy to know that Deputy has a sophisticated auto-scheduling feature. This helps predict how many staff you need on hand at any time. The app has auto-build schedule templates to handle forecasted sales, delivery orders, foot traffic, and other demand trends.

Deputy also does a great job at break and overtime management. You schedule meal or rest breaks to prompt employees to take them. There is also an option to flag breaks that are missed. As for overtime, you can set custom rates and weekly thresholds to avoid any unnecessary overtime costs. You’ll receive an alert when staff is at risk of overtime and find staff who can work the hours without penalties.

The employee timesheet is automatically populated with tracked hours along with wage and overtime calculations. You can export these reports and directly sync them with payroll apps supported by Deputy, like ADP, Paycor, and Quickbooks. This doesn’t only help streamline payroll processing but also in remaining compliant with the state’s record-keeping laws.

There are, however, some drawbacks to using Deputy. It has a very complex UI. New users will take time to navigate through the various features of the app. Many users have also noticed the disparity in features between the Android and iPhone apps.

What are Ohio Time Management Laws?

In Ohio, there are federal and state laws in place to manage the time spent by employees in the workplace, safeguarding their rights and guaranteeing fair pay for their efforts. These laws act as directives for employers, keeping them in check and minimizing any forms of abuse or exploitation. As a business operating in Ohio, here are some key laws that you should know about:

Fair Labor Standards Act

The Fair Labor Standards Act (FLSA), which dates back to 1938, is a critical federal law for time management. It sets hourly wage rates and overtime pay and requires employers to record their employees’ working hours accurately. Overtime is pegged at 1.5 times the regular hourly rate for workers who exceed 40 hours a week. However, certain job categories, including executives, professionals, and administrative employees, are exempt from overtime pay depending on their job description and salary.

Family and Medical Leave Act

The Family and Medical Leave Act (FMLA) is another essential federal law that governs time management in the workplace, entitling eligible employees to up to 12 weeks of unpaid leave for important family and medical reasons, such as childbirth, adoption, or caring for a family member with a serious health condition. This act also requires employers to maintain employees’ health benefits during their leave and restore them to their previous or equivalent positions upon their return to work.

Break Laws

In Ohio, employers are not mandated by federal or state law to offer their employees lunch breaks or rest periods during their work hours. However, if an employer decides to provide such breaks, they must relieve their employees of all duties while they are on an unpaid break, and if the breaks are under 20 minutes, they should be paid at the same hourly rate. The state of Ohio obligates employers to provide breaks for underage employees. The law specifies that minors working continuously for 5 hours or more must receive a minimum of 30 minutes for meal or rest time.

Recordkeeping Laws

Ohio state law mandates that employers maintain precise and durable employee records which include the workers’ personal information such as name, address and social security number. These records should further highlight the employee’s earnings per pay period including gross earnings exclusive of deductions as well as the date and amount of wages paid. The said records must also include the dates of hiring, rehiring, layoff or termination, along with absences, type of service provided, and other compensation excluding wages. It is essential that these records be preserved for a minimum of five years and be accessible for inspection at any time.

| Minimum Wage | $10.45 per hour |

| Overtime Laws | 1.5 times the regular wage after working 40 hours in a workweek ($15.68 per hour for minimum wage workers) |

| Break Laws | Breaks not required by law |

Employers who contravene federal time management laws face severe legal ramifications, including fines, back pay, and damages as deemed by the Department of Labor’s Wage and Hour Division. If you want to dig into further legislative details, take a look at our comprehensive Ohio Labor Laws article.

What Are The Benefits of Using Ohio-Compliant Time Tracking Software?

Compliance can be complex for Ohio businesses. That’s where Ohio-compliant time tracking software comes to the rescue. Here are some of the key benefits that the right tool can bring to your business:

- Accurate Wage Calculations: Ensure compliance with Ohio’s specific overtime, minimum wage, and break regulations, reducing the risk of legal issues and ensuring fair compensation for employees.

- Automated Recordkeeping: Simplify compliance by automatically tracking and documenting employee work hours, breaks, and time off. This greatly eliminates manual errors and ensures accurate recordkeeping.

- Streamlined Reporting: Generate comprehensive reports on employee attendance and labor costs, allowing businesses to analyze trends and make data-driven decisions. These reports are important for the timekeeping requirements of both the state and the Defense Contract Audit Agency.

- Increased Efficiency: Automating time-tracking processes frees up valuable time for HR and payroll teams, enabling them to focus on more strategic tasks, improving productivity, and allocating resources more effectively.

Does Your Business Need an Ohio-Compliant Time Tracking Software?

Any Ohio business can greatly benefit from implementing Ohio-compliant time-tracking software. Investing in the right software not only saves time and resources but also ensures accurate and fair labor practices, contributing to the success of your Ohio-based business.