This review covers:

- Overview

- What Do Users Like About Xero?

- What Don’t Users Like About Xero?

- What Pricing Plans Does Xero Offer?

- What are the Standout Features of Xero?

- Positive User Highlights

- Negative User Highlights

- What are Xero’s Ratings from Other Review Sites?

- What’s My Final Verdict on Xero?

Overview

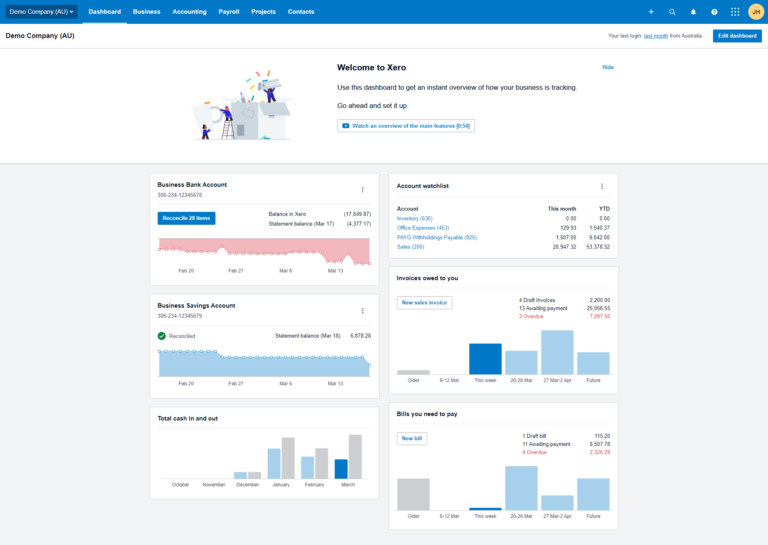

Xero is a cloud-based accounting software that is known for being a reliable and comprehensive solution for small businesses looking to streamline their financial management processes. This online accounting software allows them to connect with their banks, accountants, bookkeepers, and other business apps with ease.

I love that Xero has a robust set of features that includes invoicing, bank reconciliation, expense tracking, financial reporting, inventory management, payroll, and lots of integrations, making it a one-stop shop for all businesses’ accounting needs. With Xero, you can create professional invoices and set up automatic reminders, import and reconcile bank transactions, track expenses, manage inventory levels, process payroll, and generate various financial reports. The software also enables collaboration with multiple users and offers flexible and affordable pricing plans.

One of Xero’s key strengths is its user-friendly interface, featuring an intuitive dashboard that provides a clear overview of finances. Plus, the software facilitates collaboration among multiple users, making it easier to work together on financial tasks.

Now, there are a lot of good things going on about Xero, and I can go on and on singing its praises. However, I promised you an honest Xero review, so I must also discuss where it falls short.

Xero comes with a steep learning curve that can be daunting for first-time users and the less tech-savvy. It also has limited customization options and may present some glitches when using bank feeds, such as when transactions drop out with no notice to the file owner or bookkeeper. And when issues like these arise, support can be quite limited and untimely, which is frustrating especially when something needs immediate resolution.

The features of the lower tiers are also quite restricted in comparison with the higher ones — for example, quotes and invoices have a very limited cap lowest-priced plan, multiple currencies are only available for the highest subscription tier, and expense tracking is not available for the lower tiers. Its invoicing capabilities could also use a bit more intuition when compared with competitor programs.

However, these issues don’t detract from Xero’s overall effectiveness as a payroll software solution. The variety of its features, the affordable pricing, and its overall reliability are key factors why it’s the accounting software of choice for many businesses.

So far, we’ve only scratched the surface, and there’s a lot more to learn about the software in this Xero review. So before jumping to any conclusions, let’s first take a look at what else Xero has to offer.

What Do Users Like About Xero?

- Comprehensive suite of features

- Competitively-priced plans

- Ease of use

- Various reporting options

- Wealth of integrations

- Tracking 1099s and subcontractor details

- Free 30-day trial

What Don’t Users Like About Xero?

- Steep learning curve

- Lack of customisation in invoicing

- Glitches and bugs in the bank feed feature

- Limited and untimely support

- Many important features are only available in the higher tiers of subscription

What Pricing Plans Does Xero Offer?

Xero offers four pricing plans that cover accounting essentials with room to grow, namely Starter, Standard, and Premium. Each one has different features, but all of them have bank connections, inventory, reporting, purchase orders, files, VAT returns, and the ability to accept payments and manage Xero contacts. Several optional add-on modules enhance functionality.

Starter Plan: This plan is for solopreneurs and small business owners just starting, and includes the ability to send 20 quotes and invoices per month, enter five bills, reconcile bank transactions, capture bills and receipts with Hubdoc, and view a short-term cash flow and business snapshot. Regularly priced at £15 per month, the Starter plan can be availed at 75% off for the first six months when purchased by January 31, 2024, bringing down the price to only £3.75 per month during the discount period.

Standard Plan: This plan is best suited for growing businesses and offers the same capabilities as the Starter plan, in addition to the ability to send unlimited quotes and invoices, enter unlimited bills, and reconcile transactions in bulk. Regularly priced at £30 per month, the Starter plan can also be availed at 75% off for the first six months when purchased by January 31, 2024, bringing down the price to only £7.50 per month during the discount period.

Premium Plan: This plan is for established businesses, particularly those that service international audiences or markets. It includes all the features of the Starter and Standard plans, as well as the ability to use multiple currencies, track projects, claim expenses, and view in-depth analytics. Regularly priced at £42 per month, the Starter plan can also be availed at 75% off for the first six months when purchased by January 31, 2024, bringing down the price to only £10.50 per month during the discount period.

Ultimate Plan: This plan contains the fullness of the Xero feature arsenal, ideal for employing businesses and those with more advanced needs. It has all of the features of the previous plans, plus the automatic inclusion of the Analytics Plus add-on, payroll for up to 10 people, as well as expense claiming and project tracking for up to 5 people. Regularly priced at £55 per month, the Starter plan can also be availed at 75% off for the first six months when purchased by January 31, 2024, bringing down the price to only £13.75 per month during the discount period.

Add-ons: To expand the capabilities of the plans, Xero offers add-on modules such as Payroll, Expense Claiming, Project Tracking, Analytics Plus, and CIS Returns Submissions.

Payroll is free for the first 2 months on Starter, Standard, or Premium plans. After that, the regular price is £5 per month for up to 5 people plus £1 month per additional person. The Ultimate plan already has Payroll for 10 people, but each seat in excess of that costs £1/month.

Expense Claiming is similarly free for the first 2 months on Starter, Standard, or Premium plans. After that, the regular price is £2.5 per month for one user, plus £2.50 per month per additional active user. The Ultimate plan already has Expense Claiming for 5 users, but each seat in excess of that costs £2.50/month.

Project Tracking comes free for the first 3 months on Starter, Standard, or Premium plans. After that, the regular price is £5 per month for one user, plus £5 per month per additional active user. The Ultimate plan already has Project tracking for 5 users, but each seat in excess of that costs £5/month.

Analytics Plus is free for the first four months it is added to Starter, Standard, or Premium plans. After that, the regular price is £5 per month. The Ultimate Plan includes this add-on automatically with no additional charge.

CIS Returns Submissions can be added at £5 per month to all plans.

What are the Standout Features of Xero?

1. Invoicing and Bank Reconciliation

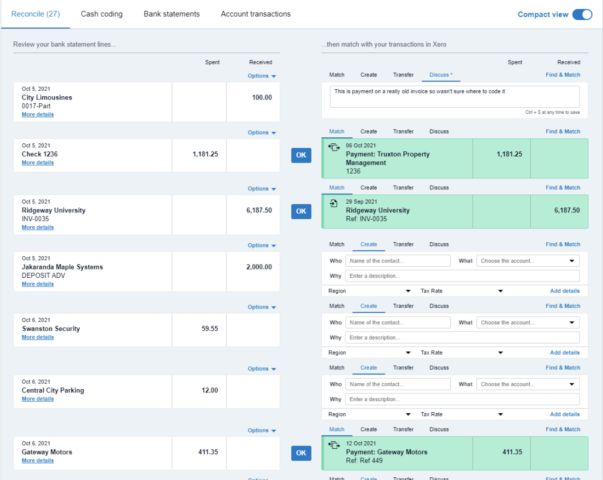

Xero’s invoicing feature allows for professional-looking invoices, quotes, and customizable templates. It also has recurring invoices and invoice tracking. Moreover, Xero’s bank reconciliation feature enables automatic transaction categorization, reconciliation, and matching. These features help businesses streamline invoicing and accounting processes, improve cash flow management, and gain insight into business finances.

2. Expense Tracking

Xero’s expense tracking feature allows businesses to capture and manage expenses on the go. With the Xero mobile app, you can snap photos of receipts, categorize expenses, and create expense claims for reimbursement. Expenses can also be attached to transactions for accurate bookkeeping and reconciliation. Additionally, Xero’s expense tracking feature gives businesses real-time visibility into their spending and helps them identify areas where they can cut costs.

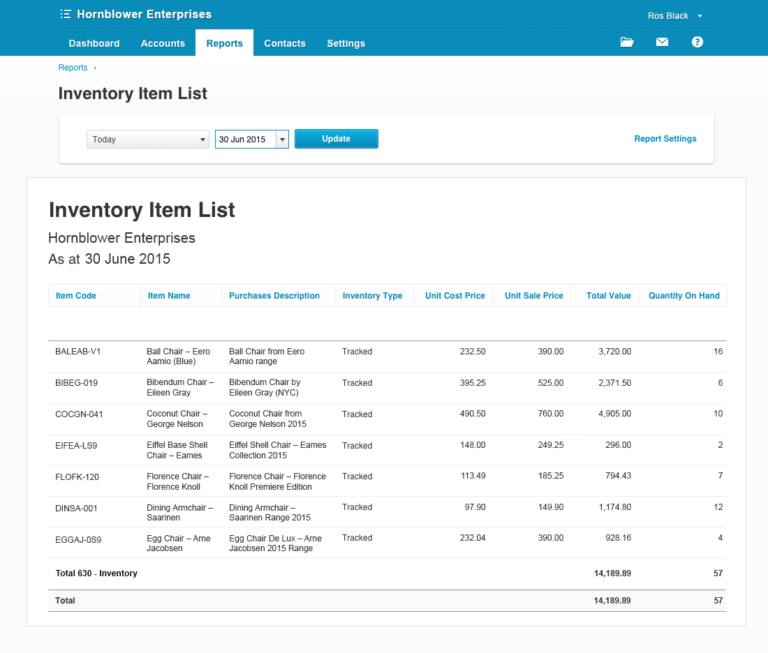

3. Inventory management

Xero’s inventory management feature allows users to track inventory levels, set up automated reordering, and generate reports to analyze sales and inventory data. Businesses can also set up and manage inventory items, create purchase orders, and manage stock across multiple locations. The feature also integrates with Xero’s invoicing and sales features, so businesses easily create invoices and track sales of their inventory items. By using Xero’s inventory management feature, businesses ensure they have the right inventory to meet customer demand while minimizing waste and optimizing profitability.

4. Time and attendance

Xero’s time and attendance feature tracks employee time and attendance, generates reports, and integrates with the payroll module. It enables employees to request time off and view their attendance records while ensuring compliance with labor laws and regulations. This feature helps streamline time-tracking, reduce errors, and improve payroll efficiency.

Selected Positive User Feedback:

- “Xero is pretty easy to use as a new company director with limited prior experience with finance or accounting software, although naturally, it takes time fully getting to grips with the platform and customising the settings to meet your needs.” – Kevin L. (Source G2)

- “Xero is easy to navigate and less intimidating than the more traditional Quickbooks. Even without the help of our accounting team, we’ve been able to generate reports and get a clearer understanding of our financials to make better decisions.” – Jazmine D.. (Source G2)

- I like the feature of tracking 1099’s and subcontractor details. Having multi-level controls on an online accounting platform is fantastic.” – Meghan M. (Source G2)

- “Great look and feel (user interface) and is well laid out – much better than MYOB online which I use to administer my local model railway club.” – Kevin M. (Source G2)

- “It does everything you need an accountancy program to do and more, it’s easy to use as you start automating processes, so reconciliation eventually becomes a few clicks.” – Charles R. (Source Software Advice)

- “Xero has a user-friendly interaction and provides a tutorial for each segment and. also; we can create a demo company for trial-and-error checks for accounting. I personally like the bank rules in the bank reconciliation segment.” – Sasrutha M. (Source G2)

- “Xero has a nice layout and is intuitive to use. Also integrates seamlessly with the accountant – no more ugly spreadsheets! It’s so helpful to be able to see my tax reports and balance sheets at a glance, throughout the year. ” – Lora L. (Source Capterra)

- “The fact that you can go back and make changes to invoices.” – Marjike V. (Source Capterra)

- “Automation and EfficiencyXero offers a wide range of automation features such as bank reconciliation, automated invoicing, receipt management, and an efficient expense management system which can help businesses to save time and reduce manual errors.” – Philip Sinothi M. (Source Capterra)

- “We maintain track of all of our financial transactions, including payroll and cash flow, with the help of Xero. It greatly improved the bookkeeping’s organization and clarity and made the process easier to handle.” – Courtney S. (Source Capterra)

- “Xero is extremely easy to use and has fantastic integration capabilities for business owners. In addition, the app allows individuals to sort their finances easily.” – Robert (Source Capterra)

- “The software has an easy-to-navigate interface. Integrates well with other software to make effortless recordkeeping.” – Nico R. (Source Capterra)

- “Easy to use software that makes business smoother.” – Adam W. (Source Capterra)

- “I like the product is easy to use, no need high knowledge of accounting, the person who never was doing accounting can easily manage this product” – Monik V. (Source Capterra)

- “It is very easy to use, and it also offers a lot of options to connect to other apps for more accessible accounting activities.” – Luka Z. (Source Capterra)

Selected Negative User Feedback:

- “There is still missing a few things as inventory shall be a bit changed as people with two inventories in different places can not have two storages, there are few things that missing and can make it easier to work with” – Monika V. (Source Capterra)

- “Many advanced features that are standard for longer established accounting software solutions are available, but as “bolt-on” packages, so costs can escalate quickly if you need full “bells and whistles”.” – Leanne M. (Source Capterra)

- “Unfortunately, the reconciliation process in XERO is a no-go for me. Rather than the Quickbooks and standard approach, where you do a monthly reconciliation against a bank statement, XERO had no such function.” – Sherm S. (Source Capterra)

- “We have had a couple of glitches where bank feeds have stopped working for periods of time, manual import of bank statements can take a few attempts to get right.” – Lain S. (Source Capterra)

- “ It would be great if the projects section was integrated with other apps, such as Expensify.” – Sara B. (Source Capterra)

- “The software does not have a tax add-on when compared to Quickbooks (Intuit). They are plenty of integrations to solve this issue but it would be nice to have. Integrating bill payment is more difficult compared to Quickbooks as well.” – Mitchel B. (Source Capterra)

- “1099 reports are too limited. Tracking categories are too limited. Support can phone it in when you first reach out to them.” -Judha K. (Source Capterra)

- “Customized reporting options are still limited” – Verified Reviewer (Source Capterra)

- “Some of the banks in my country do not have stable feeds, this makes it a bit difficult for bank rec’s.” – Jaco F. (Source Capterra)

- “One of the downsides is with the projects module; you still have to use the tracking categories. I wish that the projects module synced with everything including things like Expensify. I also wish that you could have multiple rate cards with the projects module.” – Meghan M. (Source G2)

- “When billing out a PO, you can bill it out more than the amount is for, and it can mess up with the financials on the balance sheet, etc. Also, when pulling reports, you must click on too many different things to get to where you want to go.” – Kenders G. (Source G2)

- “I would like that the invoices could be more independent and customizable one from the other when I make them, because if I want to add different information to any of them, it does not allow me to do it and the process must be done manually.” – Betania M. (Source G2)

- “It doesn’t support multi-currency in inventories, in basic plans, only inexpensive plans also, without learning/ or having some training, you can not use it. Although they have provided some supporting videos for learning.” – Rashmi D. (Source G2)

- “Process of bank reconciliation has been automated but the process got glitches causing bank feeds stopped and the entity has to restore to importing bank statements manually which takes time and attempts more than once. Inventory management needs improvement.” – Faisal Shafi A. (Source G2)

- “The expenses tracking can be formatted to allow multiple currencies to be easily uploaded in batches or real-time.” – Ibrahim B. (Source G2)

- “Xero lacks the open customization options that software like Netsuite or Dynamics offers. For a small business this will often be fine, but a scaling operation looking to automate many functions based on unique business needs may someday find they have outgrown Xero and need to undergo an (often painful) ERP migration.” – Leah B. (Source G2)

What are Xero’s Ratings from Other Review Sites?

What are Xero’s Ratings from Other Review Sites?

(As of January 2024)

- Capterra: 4.4/5

- G2: 4.3/5

- GetApp: 4.4/5

- Google Play: 4.3/5

- App Store: 4.8/5

- Software Advice: 4.4/5

What’s My Final Verdict on Xero?

Xero is a comprehensive and affordable payroll and accounting software that offers a wide range of features and integrations to help small businesses in the UK manage their finances. Its features enable businesses to automate many aspects of the payroll process, including tax calculations, deductions, and reporting. Plus, it also integrates with other modules within Xero, such as time and attendance tracking and employee self-service. The software automates the filling of 1099 forms and allows businesses to comply with labor laws and regulations, which I think is super convenient. Along with an intuitive user interface and extensive tutorials, Xero also offers a large number of integrations to customize workflow.

There are a lot of things that I like about the software, but to make this Xero review truly honest, I must say that I don’t like the steep learning curve, lack of customisation in invoicing, the limited and untimely support, and the fact that many important features are only available in the higher tiers of subscription.

Some features also require improvements, such as the bank feed which experiences frequent glitches. Additionally, I think that an increase in its customisation options would also drastically improve the overall user experience.

But aside from these minor drawbacks, Xero is a comprehensive payroll solution with a smooth user experience. It’s best for growing businesses who are actively adding employees to their ranks and need integrations with a lot of different third-party apps, and those who aren’t too accounting-savvy and need lots of color-coded visuals to assist them in making sense of business performance.

However, businesses on a budget that need less-expensive ways to send many invoices or bills and those with niche requirements that need more specialized solutions may benefit from finding other options.