This Review Covers:

- Overview

- What Do Users Like About QuickBooks Payroll?

- What Don’t Users Like About QuickBooks Payroll?

- What Pricing Plans Does QuickBooks Payroll Offer?

- What are the Standout Features of QuickBooks Payroll?

- Selected Positive User Feedback

- Selected Negative User Feedback

- What are QuickBooks Payroll’s Review Ratings from Review Sites?

- What’s My Final Verdict on QuickBooks Payroll?

Overview

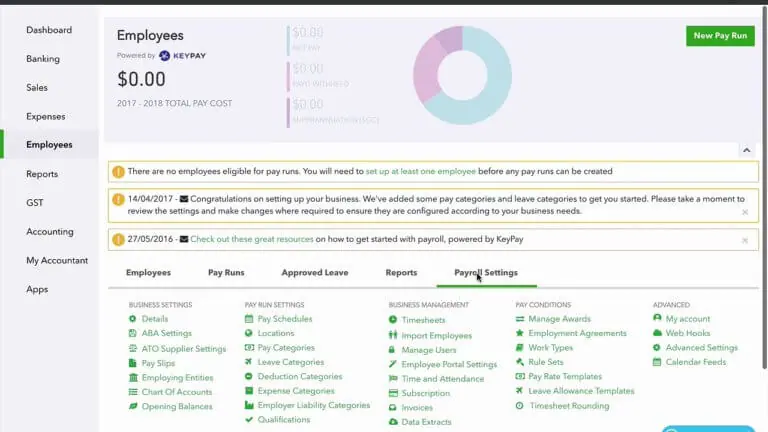

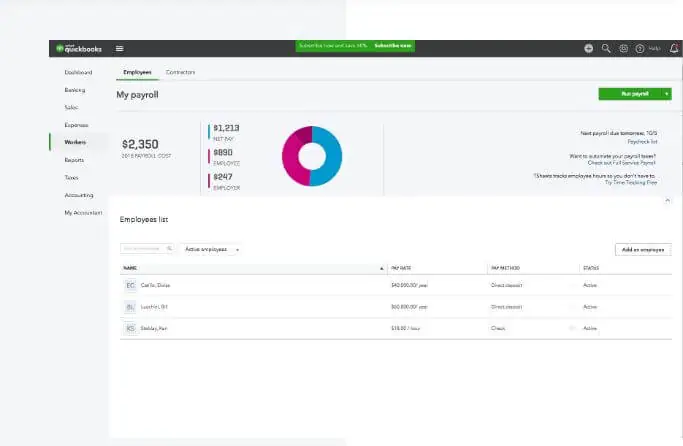

QuickBooks Payroll is a cloud-based payroll solution offered by the famous accounting software by Intuit. This payroll solution includes various impressive features and targets small businesses in particular. With automated payroll processing, direct deposit, tax calculation, and tax form generation, QuickBooks offers a refined payroll solution.

What I appreciate about QuickBooks Payroll is it is customizable, allowing businesses to choose the features and services that best meet their needs, such as HR support, health benefits, and time tracking – super convenient. And with its seamless integration with QuickBooks’ accounting software, tracking payroll expenses and generating financial reports has never been easier.

But that’s not all. I love the helpful reports, employee time and expense tracking, and tax compliance management features that come with the software. Plus, it also helps businesses generate tax forms such as W-2s and 1099s with ease.

That being said, I must admit that the software does have occasional glitches, and the customer support could be better. Additionally, the cost of US$45/month + US$6/user/month is a significant expense, especially for small businesses. The software can also be complex to set up and use, which may require some training and support. Plus, unfortunately, the software only works where there is an internet connection.

What Do Users Like About QuickBooks Payroll?

- Better scalability

- Robust security

- Accurate payroll processing

- Compliance with federal and state tax laws

What Don’t Users Like About QuickBooks Payroll?

- Slow responses from customer support

- Complicated to set up and use

- High cost

- Only works where there is an internet connection

What Pricing Plans Does QuickBooks Payroll Offer?

QuickBooks Payroll offers a few estimating plans to look over, contingent upon the requirements of your business.

Core Plan: At a base fee of $45/month and $6/user/month, the Core plan includes basic payroll features such as automated payroll, tax calculations, and free direct deposit.

Premium Plan: At a base fee of $80/month and $8/user/month, the Premium plan includes all features of the Core plan plus additional features such as same-day direct deposit, HR support center, and time tracking.

Elite Plan: At a base fee of $125/month and $10/user/month, the Elite plan includes all Premium features along with personalized setup assistance, a dedicated account manager, and TSheets Elite time tracking.

What are the Standout Features of QuickBooks Payroll?

1. Automated Payroll Processing

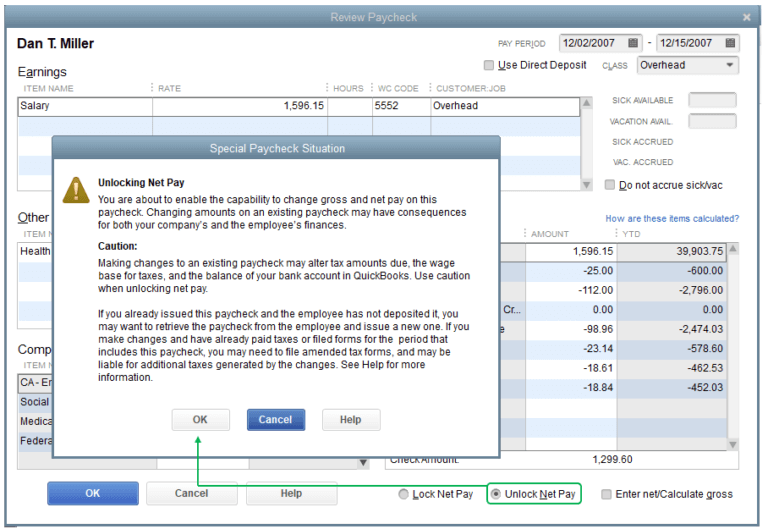

With QuickBooks Payroll, businesses can automate payroll tasks such as calculating employee wages, taxes, and deductions along with generating pay stubs and direct deposits. This feature eliminates the need for manual data entry and reduces the time spent on payroll-related tasks.

The software automatically calculates the correct amount of taxes and deductions based on each employee’s tax information and generates the necessary tax forms for businesses to file. This helps businesses stay compliant with federal and state tax laws and reduce the risk of payroll errors.

2. Direct Deposit

The direct deposit feature allows businesses to pay their employees electronically and directly into their bank accounts, reducing the need for paper checks.

Direct stores can be set up safely, and it permits organizations to pay their representatives on time and in a helpful manner. The feature can be customized to pay different employees different amounts or percentages, and it can be set up to pay employees on a recurring schedule, such as weekly, bi-weekly, or monthly.

3. Time Tracking

QuickBooks’ time tracking feature helps businesses accurately track and manage employee time and attendance. This feature allows businesses to track employee hours, overtime, and time off requests, as well as import the data directly into payroll processing. It is also customizable, allowing businesses to set up different rules for different employees or job types. It can be set up to track time using multiple devices, including a mobile app, web browser, or physical time clock. The feature can also be set up to integrate with popular time tracking software.

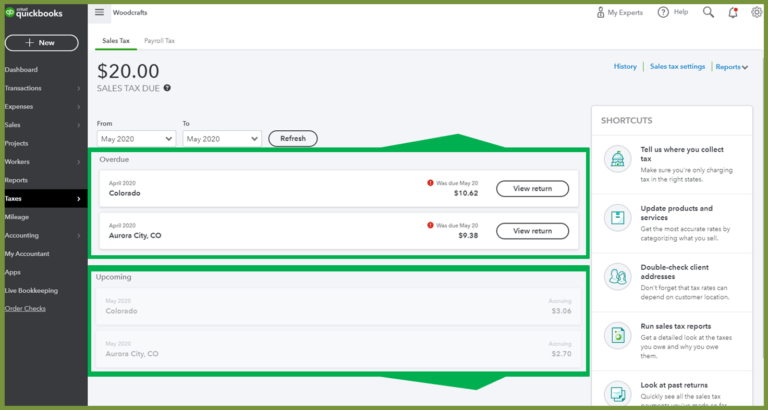

4. Tax Calculation and filing

The tax calculation and filing feature helps businesses stay compliant with federal and state tax laws. Businesses can automatically calculate the correct amount of federal and state taxes to withhold from each employee’s pay-check and generate the necessary tax forms for businesses to file.

This feature is customizable, allowing businesses to set up different tax rates for different employees or job types. Furthermore, it allows for the configuration of tax form completion and filing, including the crucial W-2s and 1099s, as well as the production of necessary paperwork.

5. HR and Employee Benefits

QuickBooks Payroll’s premium and elite plans include access to an HR support center, which offers HR tools and resources, including an employee handbook builder and a job description builder. Further to this, retirement plans can be set up by employees quickly with the assistance of professionals that manage 401(k) administration, compliance, and record-keeping at no additional cost to firms.

In order to offer their employees reasonable coverage, businesses can compare and choose health insurance. The unified online system, which offers a three-step application processes and rapid prices on plans, manages all benefits processes.

Selected Positive User Feedback:

- “I like how easy it is to process the payroll as well as pay various payroll taxes and filing tax forms.”– Verified User in Insurance (Source G2)

- “The best part is that by using Quickbooks Payroll I have confidence that the payroll calculations are correct….Quickbooks Payroll prompts me when it is time for a software update,….. CARES Act.”– Verified User in Non-profit Organization Management (Source G2)

- “Quickbooks Payroll is extremely easy to use and integrates flawlessly into the general ledger.” – Verified User in Sr Payroll and HR Administrative (Source G2)

- “Fast and direct deposit. Easy to use and time saving. Live technical support.” – Verified User in Finance(Source G2)

- “What I liked most about Quickbooks is that I can easily track and organize transactions, manage and organize expenses from anywhere, quickly reconcile your accounts and gain control of your cash flow.” – Leilani F. (Source Capterra)

- “Saves so much time each month/quarter having QuickBooks handle filing all tax documents and paying them.” – Darla B.(Source Capterra)

- “Quickbooks has enable us to roll out payroll, benefits, leave tracking for our employees without any hassle.”– Kumar P.(Source Capterra)

- “I enjoy the use of the mobile app to easily review payroll and pay my employees in a timely manner. I also enjoy the functionality of time sheets compatibility to payroll.” – Salvadore E.(Source Capterra)

- “Ease of use and peace of mind with timely filings and top notch support.” – John J.(Source Capterra)

- “QuickBooks Online Payroll is..They notify you when a report needs to be submitted, and it is ready to be sent. They take care of all the government forms, and the employees get their money by direct deposit…….State of Federal payment or required report.”– Verified User in Accounting (Source G2)

- “Quickbooks is extremely user friendly for keeping employee data, payroll, invoicing and building reports.”– Verified User in Staffing and Recruiting (Source G2)

- “I have been using QB online for several years & it’s very user friendly. I would recommend it as a reliable, user friendly option. Merchant accounts & fees are reasonable.…basic features.” -Sheree Moltzan (Source Android Store)

- “Customer service and problem resolution are generally excellent, with well-trained and proficient agents taking calls or on chat.” – Georgia C.(Source Capterra)

- “It is cheap and integrated with Quickbooks”– Wissam E.(Source Capterra)

- “The direct deposit feature in QB is the bomb, so fast and easy.”– Verified User in Information Technology and Services(Source G2)

Selected Negative User Feedback:

- “The speed of the overall software is not the best, but it gets the job done.”- Verified User in Information Technology and Services(Source G2)

- “Running final checks can be a little bit of a challenge sometimes. The system overwrites when you are trying to pay out final hours worked and accrued vacation.”- Verified User in Accounting(Source G2)

- “Calculating can be a bit slow at times and has a tendency to give unnecessary error message.”– Verified User in Human Resources(Source G2)

- “When I add new employees it doesn’t always save all the info the first time.”– Verified User in Health, Wellness and Fitness(Source G2)

- “Sometimes it takes a while to get someone on the phone.” – Kara P.(Source Capterra)

- “The setup process can be a little confusing/ time consuming at first. However, once you go through 1-2 iterations, it is a pretty straightforward process.” – Candie G.(Source Capterra)

- “The reconciliation tool for credit card charges can be challenging to use and takes additional introduction and training from an accountant to ensure it is being done correctly.”– Brianna F.(Source Capterra)

- “The direct deposit limit is what made me change payroll software. I could not pay all of my employees via direct deposit because of the limit they had on our account.”– Samantha S.(Source Capterra)

- “When we do have issues, customer service is not to par. They stopped servicing many of their payroll services and when you do, you do get switched around a lot and many seem to not know the basics of payroll….processing your company payroll.”– Sarah G.(Source Capterra)

- “I most dislike how expensive Quickbooks Payroll is.…… I think the (ever increasing) several hundred dollars per year it costs to have the subscription is unreasonable.” – Verified User in Accounting (Source Capterra)

- “Biggest issues are: -Customer service transfers you around many times because no one owns the issues with payroll with contractors. You cannot integrate a time card app because only hours are uploaded from the app to QuickBooks and we cannot map $/hr pay for contractors, only employees.”– Peggy C.(Source Capterra)

- “With QuickBooks Online, you are dependent on the availability of an Internet connection at the time you wish to process payroll.”– Paul A.(Source Capterra)

- “QBO and TSheets do not track projects at any sub-level, such as task or milestone, so employee expenses allocated to projects require painful, manual Excel manipulation to bill clients based upon task or milestone accomplishments.”– Gregorio C.(Source Capterra)

- “QB Online constantly has several bugs”– Capt Darien (Source App Store)

- “After saving an invoice or estimate without leaving the saved page, any changes that are made while staying on the same page will not be recorded so it will need to be changed a second time in order to be recorded.”– Foy R.(Source App Store)

What are QuickBooks Payroll’s Review Ratings from Other Review Sites?

(As of December 2023)

- Capterra: 4.4/5

- G2: 3.8/5

- Google Play: 4.5/5

- App Store: 4.6/5

What’s My Final Verdict on QuickBooks Payroll?

With features like automated payroll processing, direct deposit, tax calculation, and tax form generation, QuickBooks Payroll is a comprehensive payroll solution offered by the giant, QuickBooks.

One of my favorite things about QuickBooks Payroll is how customizable it is. You can choose the features and services that best suit your business, whether it’s HR support, health benefits, or time tracking. Furthermore, QuickBooks Payroll automatically generates W-2 forms and fills in necessary data for 1099s, which it then transmits electronically. Employers can also upload IRS notices they’ve received into QuickBooks Payroll and receive assistance and updates on the notice’s status.

A part of the powerful QuickBooks accounting software, you can easily manage payroll while tracking payroll expenses and generating financial reports. With the integration feature, businesses find it incredibly easy to manage payroll tasks and keep track of expenses. Plus, the automation of payroll tasks is a real time-saver. No more crunching numbers or double-checking calculations – let the software do all tasks.

Nonetheless, I’ve heard customer support can be a bit hit or miss, and there have been some occasional glitches in the software. As for the cost, I agree that it can be a bit steep for small businesses. At US$45/month plus US$6/user/month, it’s not exactly cheap.

Further, I want you to know that setting up and using QuickBooks Payroll is also complex. This is incredibly time-consuming for those unfamiliar with the software or payroll processes in general. Regrettably, the software is limited to working only in areas with internet connectivity – quite a bummer if you ask me.

To conclude, QuickBooks Payroll is an impressive branch of the QuickBooks powerhouse, and it does offer a solid solution, but like other QuickBooks solutions, the pricing is a bit steep and it’s not exactly a smooth experience all the time.