The definitive list:

- Automated time tracking

- Customizable timesheets

- Accessible from any device

- Extensive reporting capabilities

- Effortlessly sync with QuickBooks

Jibble stands as the top QuickBooks integration for time tracking, providing free and seamless time tracking capabilities. Jibble is available on both web browsers and mobile phones, providing time tracking for employees on-site or on-the-go. Its features go beyond time tracking, providing added security through features like facial recognition and geofenced locations, ensuring precise clock-ins.

By connecting Jibble with QuickBooks, you can seamlessly manage employee hours and payroll, making your accounting processes smarter and more efficient. This integration allows you to sync timesheets with just a few clicks, eliminating manual data re-entry and saving hours of administrative time. Data collected by tracking hours in Jibble can be utilized in QuickBooks Online. By automating the process, you can run payroll faster and with greater accuracy, ensuring consistency and reliability in your financial records.

The seamless syncing between platforms ensures that your books are always up to date, allowing you to make timely adjustments and stay on top of your finances.

Getting started with Jibble and QuickBooks Online integration is a breeze. Simply create an account with Jibble, and then connect it to your QuickBooks Online account. Once linked, you can directly send timesheet data from Jibble to QuickBooks Online, automating your payroll process effortlessly

As an additional enticement, Jibble offers its time tracking software for free forever, allowing unlimited users to benefit from its seamless integration with QuickBooks Online. With Jibble, you can optimize your time tracking and payroll processes, freeing up valuable resources to focus on growing and improving your business.

- Custom reports

- Self-serve contact portals

- Customer/Vendor management

- Real-time, two-way sync with QuickBooks

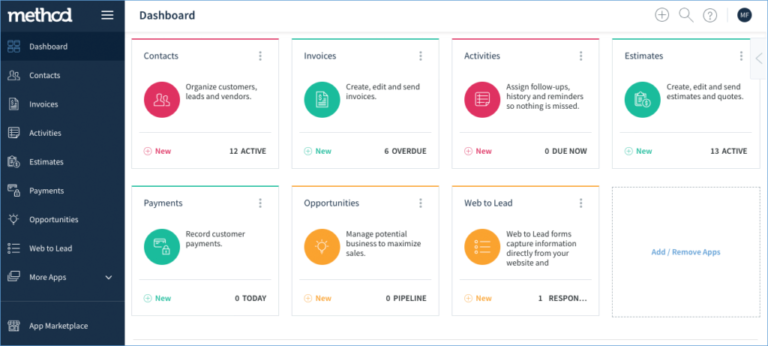

Method:CRM is the industry-leading CRM platform on Intuit’s apps.com. It works effortlessly with all versions of QuickBooks, including desktop versions, empowering businesses to operate from anywhere on any device. Method:CRM fills the gap left by QuickBooks, enabling businesses to manage potential sales, track opportunities, create estimates, and convert leads into QuickBooks customers effortlessly.

Method:CRM’s real-time syncing of purchase history, preferences, and interactions provides a comprehensive view of each customer. Its online portals enhance customer service and automation, giving customers 24/7 access to update information, view estimates, and make payments, all of which sync instantly to QuickBooks.

Method:CRM’s user-friendly features, including creating estimates, sales orders, invoices, templates, and more, streamline workflows without the need to log into QuickBooks. Additionally, you can personalize it to simplify other tasks like e-signature capture, approvals, or sales commission tracking.

Method:CRM’s integration with QuickBooks ensures smooth communication history tracking and effective client nurturing. Method:CRM is the ultimate tool for businesses seeking to enhance CRM capabilities and streamline operations.

- Import credit cards

- Integration capabilities

- Customizable workflow

- One-click receipt scanner

- Tax tracking

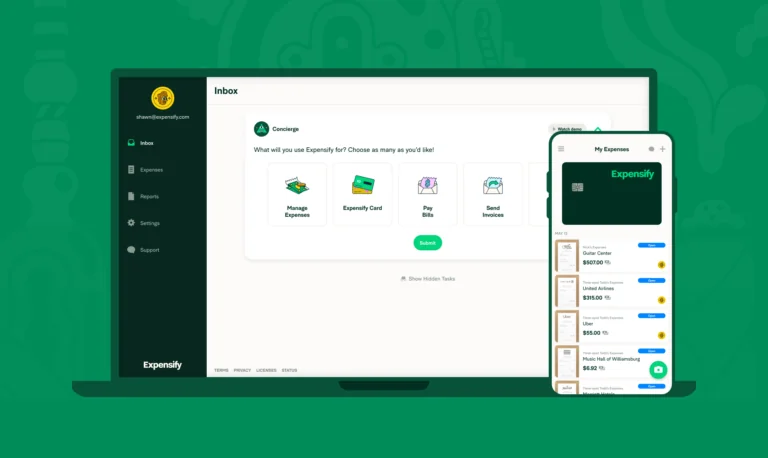

Expensify automates expense management and receipt tracking, freeing you to focus on what you love most about running your business. No more holding onto old paper receipts or waiting for accounting department approvals. The app seamlessly synchronizes invoices and expenses to QuickBooks, streamlining financial processes and saving valuable time.

One of its standout features is its customization capabilities. You can code expenses to your exact preferences, including QuickBooks expense accounts, customers/jobs, classes, locations, items, and more. This level of customization ensures accurate categorization of expense data, facilitating better analysis and management of your company’s financials.

The integration with QuickBooks is fully automated, revolutionizing expense tracking. You can set your expense policy, and Expensify’s advanced automation handles the heavy lifting. Real-time synchronization ensures that employee expense records are up-to-date and accurately coded, giving administrators better visibility into company financials.

Expensify also provides full support for corporate cards, enabling centralized management of your team’s corporate cards and simplifying non-reimbursable expense reporting. Real-time insight into company spending streamlines expense reporting, making it more efficient and transparent. Additionally, the fast, next-day ACH reimbursement process ensures prompt reimbursement for approved expense reports, enhancing employee satisfaction and productivity.

- Online store

- Sales channel

- Customer segmentation

- International market management

Shopify is a commerce platform where you can start, build, and manage your own business. This QuickBooks integration revolutionizes the way e-commerce sellers manage their businesses by saving them valuable time and optimizing their financial processes. Once connected, the magic unfolds as sellers witness their Shopify orders and payouts seamlessly flow into QuickBooks, providing a consolidated and clear view of their income and expenses, all within the familiar QuickBooks environment. Setting up the integration is remarkably easy and swift, enabling sellers to streamline their financial tasks and embrace stress-free bookkeeping.

This integration can accurately categorize revenue, taxes, and fees, ensuring a precise representation of the financial landscape. This invaluable feature empowers sellers to stay on top of their finances with ease and confidence. Moreover, Shopify’s QuickBooks integration is not just about financial management; it enhances overall business efficiency. Accessible on the go, sellers can track income and expenses, manage bills, send invoices, and even monitor mileage—all from the convenience of their mobile devices.

This synergy between Shopify and QuickBooks presents a potent combination that amplifies productivity and effectiveness, liberating sellers from the shackles of manual tasks.

- In-app notifications

- Backorder tracking

- Automated order processing

- Advance inventory management

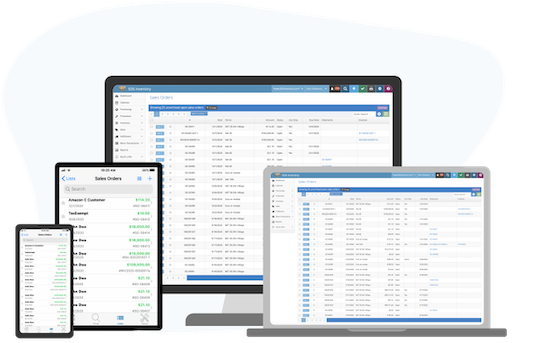

SOS Inventory is the ultimate QuickBooks Online integration for small businesses seeking efficient inventory management. Designed to seamlessly integrate with QuickBooks Online and require minimal set-up time, SOS Inventory provides a comprehensive solution to the inventory challenges faced by small business owners.

While QuickBooks Online is widely trusted for bookkeeping, it falls short when it comes to handling inventory-related complexities. For businesses involved in buying, selling, manufacturing, or warehousing products, additional inventory management capabilities are essential. SOS Inventory steps in to fill these gaps, offering features like managing backorders, calculating average cost, handling negative stock-on-hand, enabling the closing of books even with negative inventory, and providing custom field options for inventory.

When paired with QuickBooks Online, SOS Inventory transforms the platform into a powerful and fine-tuned engine for managing manufacturing, sales orders, and inventory. With SOS Inventory, businesses gain a complete picture of their operations, accurately track inventory on hand, and efficiently manage every aspect of their business processes, ultimately saving time and money.

By addressing the inventory management limitations of QuickBooks Online, SOS Inventory becomes a preferred choice for small businesses. Its ability to seamlessly complement and enhance QuickBooks Online makes it an ideal solution for businesses looking for increased functionality, ease of use, and affordability.

- Fraud protection

- Supports bank transfers

- Multi-currency payment options

PayPal emerges as one of the best QuickBooks integrations offering a seamless and efficient way to get paid. PayPal is a widely-used online payment method that allows you to make or receive payments over the Internet. Connecting to PayPal in QuickBooks enhances flexibility—customers can make payments via PayPal, credit cards, or debit cards, even if they don’t have a PayPal account. This expedites the payment process and enhances customer satisfaction. PayPal ensures transactions are monitored in real-time to prevent fraud, providing an additional layer of security for businesses and customers alike.

Setting up the PayPal-QuickBooks integration is a breeze—just a few simple steps within QuickBooks, and businesses can start enjoying the benefits. By offering PayPal as a payment option on QuickBooks invoices, businesses increase the likelihood of getting paid promptly, as customers find it easy and convenient to settle their bills.

In addition to its ease of use and security, PayPal integration saves businesses valuable accounting time. All PayPal payments and fees are automatically recorded in QuickBooks, eliminating the need for manual data entry and ensuring accurate financial records.

- Financial reports

- Interactive dashboards

- Data analytics feature

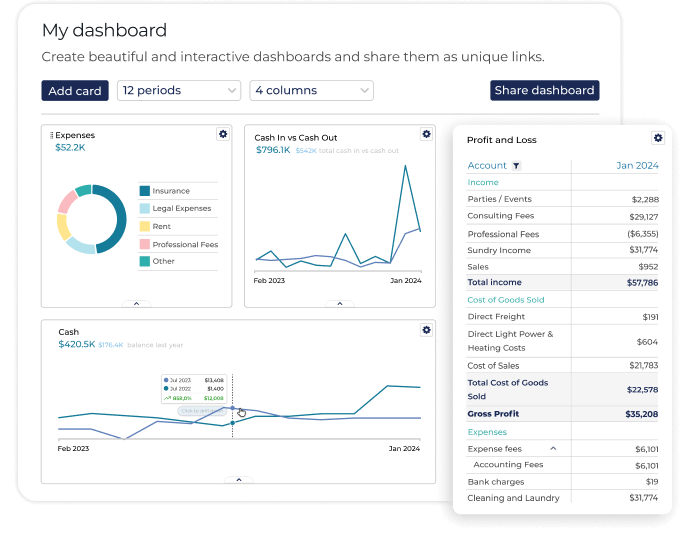

Syft is an intuitive and powerful recording and analytics app, seamlessly integrating with QuickBooks Online to unlock the full potential of your accounting data. With Syft Analytics, visualizing your financial data becomes a breeze. Customizable graphs and dashboards allow you to create compelling visual representations of your business’s performance, enabling you to spot trends and patterns at a glance. The app unifies data from different parts of your business, providing a comprehensive view of your overall business performance relative to industry benchmarks.

One of the standout features of Syft is its ability to create financial forecasts and budgets, helping you chart a clear path toward your financial goals. You will be able to estimate the value of your entity and gain invaluable foresight into your business’s future.

The integration between Syft and QuickBooks Online further enhances your financial capabilities. Seamlessly transferring data, Syft unlocks functionalities, including reporting, visualization, consolidation, forecasting, budgeting, valuations, taxes, and benchmarking. All these features can be effortlessly combined into custom PDF report packs, tailored to suit your specific needs.

With QuickBooks Online sharing essential data, such as accounts, contacts, invoices, journals, and bank transactions, Syft Analytics transforms your raw financial data into actionable insights.