Minnesota paid leave law finalized ahead of 2026 start date

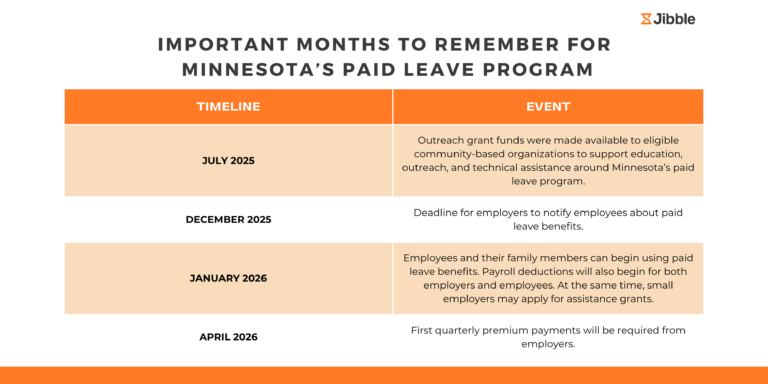

Minnesota’s Paid Family and Medical Leave is set to go into effect in January 2026, following the publication of the finalized administrative rules regulating it by the Minnesota Department of Employment and Economic Development (MN DEED) on June 16, 2025.

The MN DEED provides several business financing programs, such as the Minnesota Investment Fund and the Minnesota Job Creation Fund. These initiatives aim to support job growth and promote broader economic development across Minnesota.

Within the finalized guidelines, partial wage replacement and job protections are available for eligible employees who take time off due to a qualifying reason.

Such benefits are funded through premiums contributed by both employers and employees and are paid out by the state.

Premium collection will begin in January, and employers must notify workers about the program by December 2025.

Eligible employees, through the new law, are also entitled to up to 12 weeks of medical leave and up to 12 weeks of family leave per year.

Family leave includes time taken off for bonding with a new child, caring for a seriously ill family member, addressing issues related to gender-based violence, or supporting a family member called to active military duty.

Both leave types could be taken within a year provided the duration does not exceed 20 weeks.

Premium Rate and Cost Breakdown for Employers

The premium rate is set on an annual basis and is legally capped at a maximum of 1.1%. For 2026, the rate has been set at 0.88% of taxable wages.

The rate is funded mainly through employer contributions collected as payroll premiums, employers are required to pay at least half of the premium amount.

The remaining amount may be deducted from the employee’s wage, as long as doing so does not lower the employee’s pay below the state’s minimum wage (US$ 11.13 per hour as of January 2025).

The premium is determined based on factors such as the number of employees and total payroll, and it is not influenced by how often employees use paid leave benefits.

A lower premium rate is available for smaller employers, with 30 or fewer employees and average wages for employees below 150% of the statewide average.

Before making any payroll deductions under the paid leave program, employers must provide written notice to employees explaining the changes.

Alternative Compliance Paths for Employers

Employers who do not wish to partake in the payment of premiums may fulfill their paid leave obligations by offering an equivalent plan that meets or exceeds the benefits provided by the state.

For example, an insurance carrier plan is a type of equivalent plan sold by a private insurance carrier to meet the requirements of the Minnesota paid leave law.

Efforts are also underway to certify various insurance carrier plans to meet the requirements by the Insurance Division of the Minnesota Commerce Department.

However, employers are still required to turn in quarterly wage reports to the state and they must meet the requirements to provide notice of such action.

Tax Treatment of Premiums and Benefits

Employers may deduct their portion of premium contributions as an excise tax, which is a tax charged on certain goods, services, or payments made by businesses.

If they contribute more than the required share, the excess may be claimed as a business expense and the additional contribution must be included as a wage on the employee’s W-2 Form.

The W-2, or Wage and Tax Statement, is a federal form in the US that employers must provide to each employee and file with the Social Security Administration (SSA) each year. It reports an employee’s annual wages and the taxes withheld.

For medical leave benefits, the taxable portion must be reported by employers as wages on the employee’s W-2, and employers are also required to pay their share of Social Security and Medicare taxes.

Combining Paid Leave with Other Leave Plans

Employees cannot be forced to use other accrued leave (e.g., Minnesota Earned Sick and Safe Time (ESST), vacation days, or personal time off) before or during the paid family leave.

Employees eligible for all leave types may choose to use the other leave types to supplement or replace paid leave benefits, up to their normal wages.

Paid leave may be required by employers to run concurrently with leave taken under the federal Family and Medical Leave Act (FMLA) or the Minnesota Parenting and Pregnancy Leave law, as long as the employee is entitled to leave under both programs.

If an employee receives wage replacement from their employer during leave, and the combined total of paid leave benefits and other payments exceeds their usual wages, the extra amount must be paid back to the employer.

Employees receiving disability insurance benefits and paid leave simultaneously might face a reduction in the disability payments by the disability insurer as per the terms of the insurance policy.

Related Content

The Ultimate Guide to Managing Employee Leave