This review covers:

- Overview

- What Do Users Like About BrightPay?

- What Don’t Users Don’t Like About BrightPay?

- What Pricing Plans Does BrightPay Offer?

- What are the Standout Features of BrightPay?

- Positive User Highlights

- Negative User Highlights

- What are BrightPay’s Ratings from Other Review Sites?

- What’s My Final Verdict on BrightPay?

Overview

Let’s talk about BrightPay — a desktop-based software that promises to streamline payroll processes including payroll calculation, taxes, and deductions, and allows users to manage employee records with ease.

BrightPay is available for both Microsoft Windows and Apple Mac OS X. It can be installed on up to 10 computers, and can be supplemented with an optional cloud add-on called BrightPay Connect, which has online features such as an automated cloud backup, online employer dashboards, annual leave management, and an employee self-service portal. Payroll processing remains with the desktop app, but payroll information is securely stored in the BrightPay Connect online server.

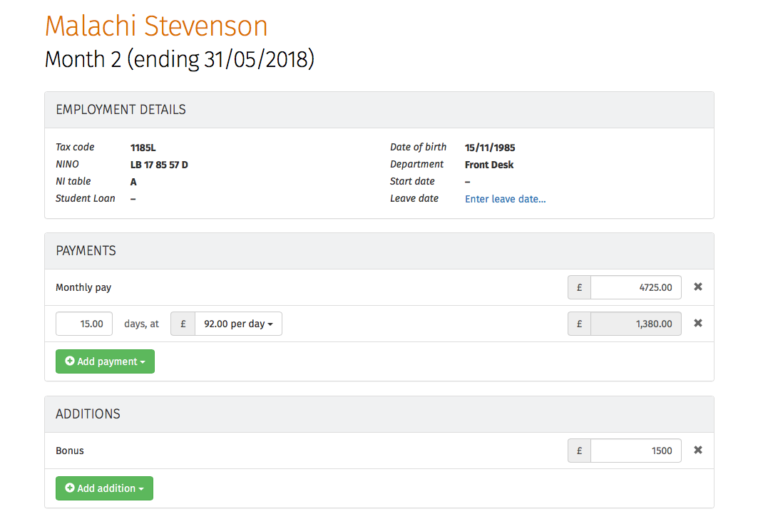

The software has a user-friendly interface, affordable pricing, and a host of helpful features, such as the client payroll entry portal where bureaus can share payment information and documents securely with clients which I think is quite a thoughtful touch. In addition to that, it’s also priced quite affordably.

One of the things I really like about BrightPay is that it’s fully equipped to handle pension management features, which are essential for complying with RTI and HMRC regulations. It also has auto-enrolment functionality and a CIS module that comes at no additional cost. Plus, it even integrates with BACS payment services for subcontractors, making the payment process as smooth as silk.

I could go on and on about what I like about the software, but I promised you an honest BrightPay review, so I must also discuss its shortcomings.

First and foremost, the software does not offer the level of customisation that large businesses require, severely limiting its usability. In addition to that, another huge cause of concern is the confusing and inconvenient backup and data restoration process that they offer, which in my opinion needs a lot of improvement to make the experience seamless. To cap it all off, customer support has a delayed response time, which can be quite frustrating especially when immediate response or assistance is needed.

Now, that’s just the tip of the iceberg, and there’s a lot more that we should discuss before making any judgments. So, without further ado, let’s dive right into this BrightPay review.

What Do Users Like About BrightPay?

- Eases payment process for subcontractors

- User-friendly interface and smooth operating system

- Inexpensive and integrates with payroll software

- Easy input of pay figures and automates regular payrolls

What Don’t Users Like About BrightPay?

- Lack of advanced features compared to other software options

- Lack of customisations

- Inconvenient backup and data restoration process

- Substandard customer support

What Pricing Plans Does BrightPay Offer?

BrightPay offers several pricing plans for the desktop app that are tailored for various needs, from micro employers to payroll service providers. The cloud-based add-on is separately priced based on the number of employees.

Standard: This plan for the desktop app is designed for use by a single employer, with three price variants depending on the number of employees. For small employers with up to 10 employees, the licence costs £139. For medium-sized employers with up to 25 employees, the price goes up to £209. Large employers who need seats for unlimited employees would need to shell out £289, which is still relatively affordable. There’s also an option for micro employers with up to three employees that costs only £79, which comes with full functionality and free support.

Bureau: This plan, still for the desktop app, is designed for use by payroll service providers. Like the Standard plan, the Bureau plan is also divided into three tiers, but this time according to the number of employers. For small payroll bureaus with up to 10 employers, the software costs £329. For medium-sized payroll bureaus with up to 25 employees, the price climbs to £549. For large payroll bureaus with needs for seats for unlimited employers, the cost goes up to £689. All bureau sizes come with seats for unlimited employees.

BrightPay Connect: This add-on supplements the functionality of the desktop app with an automated backup of payroll data to the cloud, as well as a web-based self-service dashboard for both employees and clients. Prices start at £0.6 per month for one employee and go up to £194.52 per month for 1000 employees. They also offer annual payment options that come at discounted prices, which can be discussed with BrightPay sales representatives.

Although BrightPay does not have free plans, they offer a 60-day free trial period for users to test out their system without the pressure of commitment.

What are the Standout Features of BrightPay?

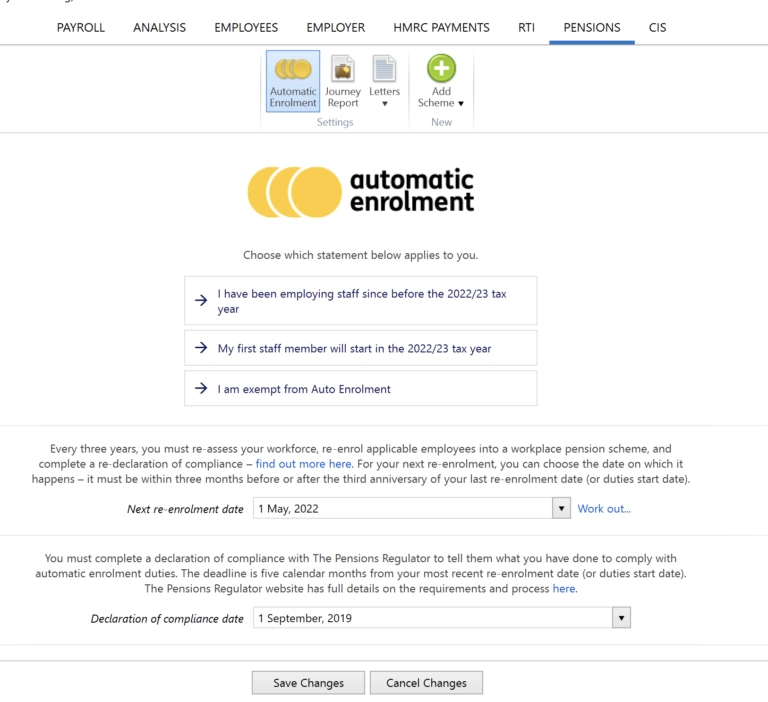

1. BrightPay Auto-enrolment

The Pensions Act 2008 mandates every employer in the UK to enrol eligible staff into a workplace pension scheme and contribute towards it, which is an initiative by the Government to help more people save up for their retirement years through a pension scheme at work. Employers with at least one employee need to fulfill certain duties to be fully compliant with automatic enrolment, such as setting up a pension scheme, enrolling eligible employees into it, deducting pension contributions from employees’ pay, and so much more.

BrightPay’s auto-enrolment features help make the process easy by streamlining and automating employee assessment, enrolment, personalised auto enrolment letters, postponement, opt-in requests, opt-out requests and refunds, ongoing employee monitoring, and re-enrolment.

It also allows businesses to choose from various pension providers and set custom contribution rates. Furthermore, the software generates communications to employees and keeps a record of all communications sent. And best of all, BrightPay’s auto-enrolment feature complies with the Pensions Regulator’s requirements.

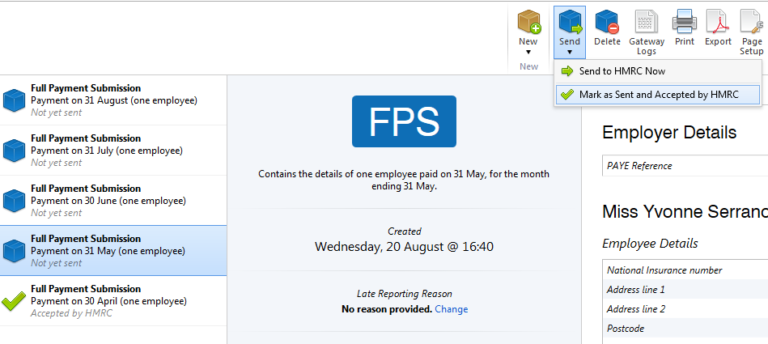

2. BrightPay HMRC RTI Submissions

BrightPay’s HMRC RTI submissions feature enables users to submit Real-time Information reports to HMRC directly from the software, ensuring compliance with HMRC regulations and accurate payroll processing. With this feature, users securely submit details about employee earnings, tax, and National Insurance contributions through the software.

BrightPay also includes features such as automatic pension enrolment and payroll reporting, making it a comprehensive payroll solution suitable for businesses of all sizes.

3. BrightPay Bureau Billing

BrightPay’s billing feature manages and automates client billing. Users can set up multiple billing methods, customise invoices, and send automatic email reminders. The feature includes detailed reporting for revenue, expenses, and profitability.

Furthermore, the billing feature streamlines the billing process, saving time and improving billing efficiency. It also improves financial transparency and accuracy for the service provider and their clients.

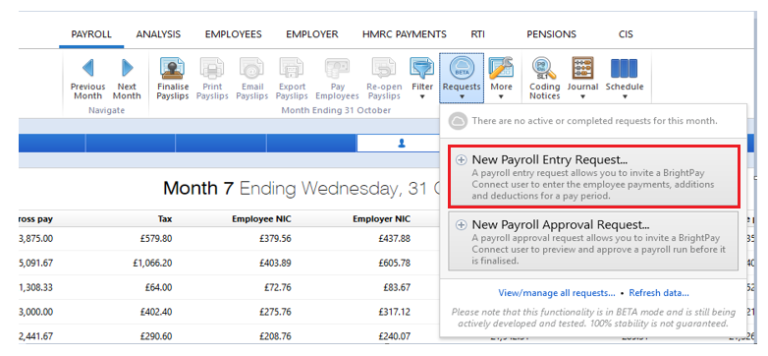

4. BrightPay Client Payroll Entry Portal

BrightPay’s client payroll entry portal enables bureaus to share payment information and documents with clients securely. Clients can enter receipts data directly and access payslips as well as other payroll documents through a secure online portal. Additionally, the portal offers a branding option, allowing bureaus to customise the experience for their clients with their company logo and brand colors.

Selected Positive User Feedback:

- “BrightPay makes the payment process easier and organized more specifically for the subcontractor.” – Verified User (Source G2)

- “Its super friendly user interface and very smooth operating system will always accurate and give the complete satisfaction on using BrightPay and recommendable to everyone.” – Usman M. (Source G2)

- “Love that the software is user-friendly and intuitive, with a pleasant-looking interface. The customer support has also been fantastic.” – Sam W. (Source Capterra)

- “Inexpensive and talks directly to payroll software.” – Mark M. (Source Capterra)

- “This program simplifies payroll processing. The UI is simple to use, and entering salary data is a breeze. The program automates regular payrolls by rolling over numbers month after month and generating variation indications.” – Yousaf B. (Source Capterra)

- “The user interface is great and very intuitive, and the help/support section is very good in helping you get up to speed with the software.” – Michael D. (Source Capterra)

- “This software makes running payroll easy. The interface is very user-friendly and inputting pay figures is a cinch. The software takes the legwork out of running regular payrolls by rolling over figures month-to-month and providing variance indicators” – Sam J. (Source Capterra)

- “The fact that you can go back and make changes to invoices.” – Marjike V. (Source Capterra)

- “Holiday/hours tracking, pay rate management, tax compliant.” – Sejal S. (Source Capterra)

- “Good value and very easy to use software that meets all the requirements of a payroll bureau and standalone payroll.” – John J. (Source Capterra)

- “Is easy to use, the best payroll software I have used.” – Sophie W. (Source Capterra)

- “Pensions included as standard – cost – look and feel – multiple users included – online employee portal add-on.” – Daryl G. (Source Capterra)

- “Very easy to use, no experience needed. I’ve got only one sometimes two employees at any one time but the customer service is out of this world.” – Andrea N. (Source Capterra)

- “Easy to use. Value for money, customer service staff are supportive and helpful, as a charity we have benefitted a lot and saved a lot of money. Thank you.” – Yousuf M. (Source Capterra)

- “Everything is built in – it is so easy to use There is no charge for charities and super small businesses that wish to run their own payroll.” – David F. (Source Capterra)

Selected Negative User Feedback:

- “What I wish brightpay must have is the capacity to trace back or correct some input of records for example some alteration may have done but it is hard to trace back the records.” – Jonathan T. (Source Capterra)

- “I would love it to be cloud-based (which is in the pipeline), and also more batch processing features.” – Sam W. (Source Capterra)

- “Lacking on customization and some of the more advanced features available in other software” – Mark M. (Source Capterra)

- “User customization could use some upgrades. I’d like to be able to change the formatting and most-used columns and set up my dashboard more to my liking. ” – Rosie C. (Source Capterra)

- “The customer support is below average at times when I or my employees have had urgent questions and concerns.” – Chris N. (Source Capterra)

- “Would be nice to be able to attach documents to employee records i.e. contract of employment, disciplinary letters, etc..” – James K. (Source Capterra)

- “ We have found backing up data and restoring the date a bit confusing at times. ” – Sol S. (Source Capterra)

- “It would be great if there was some kind of front-end graphical dashboard.” – Ajit R. (Source Capterra)

- “Backing up and restoring data is occasionally confusing -you do need to download a new program each year -hard to come up with negatives!” – Colleen L. (Source Capterra)

- “The free version is only available for one client which at my end of the market means that it is not cost-effective to have a bureau license.” – John M. (Source Capterra)

- “Improvement of customer service from the support team” – Angela Linda N. (Source Capterra)

- “User customization could use some upgrades. I’d like to be able to change the formatting and most-used columns and set up my dashboard more to my liking. ” – Rosie (Source Software Advice)

- “Looking forward to better customer support.” – Mary May L. (Source Capterra)

- “I wish they have better customer support. And also it is not very compatible with Mac machines. But this is not a major issue for us since we have windows too.” – Qiang M. (Source G2)

- “it doesn’t allow you to go back in time so you have to restore an earlier version if you want to check any previous years’ data or make a P60” – Terry F. (Source Capterra)

Ratings from Other Reviews

(As of January 2024)

- Capterra: 4.8/5

- G2: 3.6/5

- Trustpilot: 4.5/5

- Software Advice: 4.9/5

- Google Play Store: 2.9/5

- App Store: 2.7/5

What’s My Final Verdict on BrightPay?

BrightPay is a multi-awarded software serving over 300,000 businesses in the UK and Ireland. Its automated payroll calculations, employee record management, and pension management make it a great option for businesses looking for an all-in-one solution.

I particularly appreciate its client payroll entry portal, which increases transparency between bureaus and clients and ensures a smooth payroll experience. I also think that BrightPay’s auto-enrolment feature is quite cool – it’s a great tool for businesses looking to automate and streamline the entire automatic enrolment process in a way that is fully compliant with the Pensions Regulator’s requirements.

However, I think it’s important to note that compared to competitors, BrightPay lacks some advanced features. The backup and data restoration process for BrightPay is a cause for concern as well, as it can be quite confusing and inconvenient. To add to that, the platform also can’t provide customizations required by large businesses, which severely limits its functionality. Furthermore, its customer service response times are also delayed, which can be quite frustrating especially when addressing issues that need immediate resolution.

Despite these limitations, I still believe BrightPay offers a solid payroll software solution with impressive features, but it needs to keep up with competitors feature-wise, up its ante in customer support, and improve data restoration processes for it to be the go-to choice for businesses in the UK.