As a CEO of a time tracking software company I need to know what my competitors are up to. That means I’m often researching about and/or playing around with their products, you know, it’s part of the job. Thus, this Patriot Payroll review. Here, I share my findings of that research, giving credit to those competitors where credit is due and being honest about which products I believe you really need to avoid. And so, there you have it, this Patriot Payroll review, and in it, I try to be honest, fair, and insightful…

This Review Covers:

- Overview

- What Do Users Like About Patriot?

- What Don’t Users Like About Patriot?

- What Pricing Plans Does Patriot Offer?

- What are the Standout Features of Patriot?

- Positive User Highlights

- Negative User Highlights

- What are Patriot’s Rating from Other Review Sites?

- What’s My Final Verdict on Patriot?

Overview

Let me to introduce you to Patriot, a payroll and HR software that is as intuitive as it is affordable.

Starting with the basics – Patriot offers all the standard payroll features you’d expect, such as tax calculations, direct deposit, and employee self-service portals. Patriot also offers some unique features that make it stand out from the crowd, such as time off accruals, net-to-gross payroll tool, HR integration, and contractor payroll.

What I like about Patriot is its cloud-based platform and automation of tax calculations and filings. Using the software, you can rest easy knowing that you’re in compliance with tax regulations. Plus, if you’re already using other Patriot software solutions, such as Patriot Time and Patriot HR, you’ll be pleased to know that Patriot offers seamless integration with these platforms.

But wait, there’s even more! Patriot also offers competent customer support that’s readily available through phone, email, and live chat.

But, I’ve heard Patriot has limited customization options and lacks advanced reporting features. Additionally, it has fewer integrations with other business tools, and there have been reports of errors in calculations or tax filings. Oh, and one more thing – at the moment, Patriot does not have a mobile app, which is quite a bummer if you ask me. However, it can be accessed using mobile web browsers.

What Do Users Like About Patriot?

- Affordable pricing

- Unlimited payrolls

- Contractor payments

- Simple UI

- Employee portal where workers can see payments, history, tax forms and more

What Don’t Users Like About Patriot?

- Errors in tax filings

- Limited customization options

- No mobile app

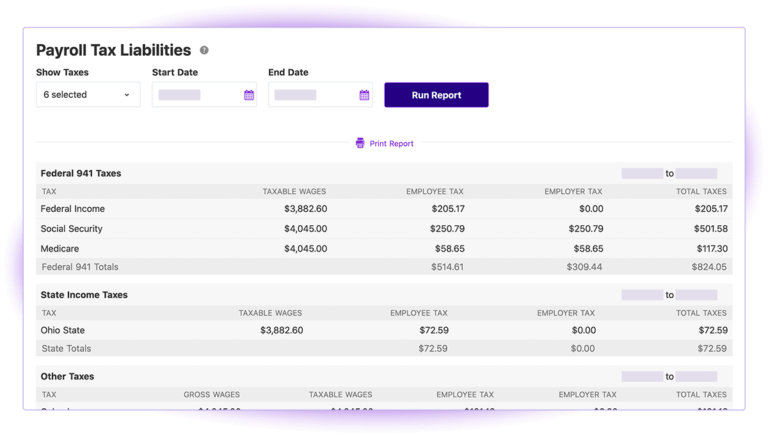

- Lack of advanced reporting features

What Pricing Plans Does Patriot Offer?

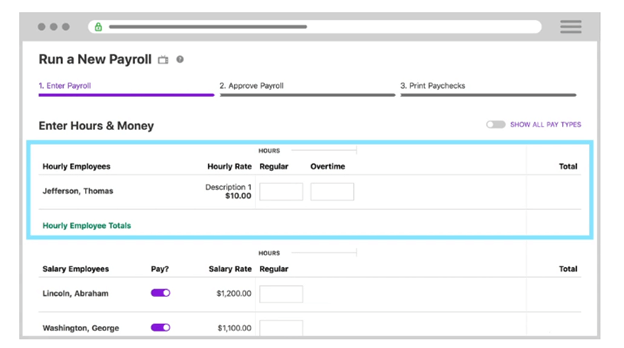

Patriot offers two plans, namely the Basic Payroll and the Full-Service Payroll plans. While both plans present a multitude of similar tools, there are a few subtle disparities that set them apart.

Basic Payroll plan: At a base fee of US$17/month and $4/user/month, the Basic Payroll plan includes all the must-have features — free support, easy setup, accounting tools, multiple payrolls, employee portals, direct deposits, and time-tracking. This plan does not allow companies to manage and file taxes, including payroll taxes, with Patriot.

Full-Service Payroll plan: At a base fee of US$37/month and $4/user/month, this plan includes everything that Basic Payroll has along with the added benefit of having their taxes, both state and federal, handled for them.

What are the Standout Features of Patriot?

1. Net to Gross Payroll Tool

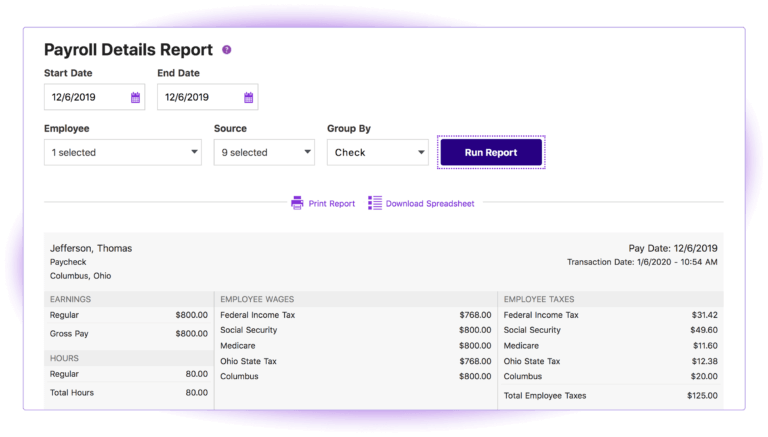

Patriot’s net-to-gross payroll tool enables employers to calculate an employee’s gross pay based on their net pay, providing a valuable feature for payroll management. It accommodates various reasons for adjusting gross pay, such as calculating bonuses or making tax and deduction adjustments. By entering an employee’s net pay, the system uses the employee’s tax information and deductions to calculate the gross pay accurately. Moreover, it considers federal and state tax rates, FICA taxes, and other deductions, providing a reliable and accurate calculation of gross pay.

2. Payment Options

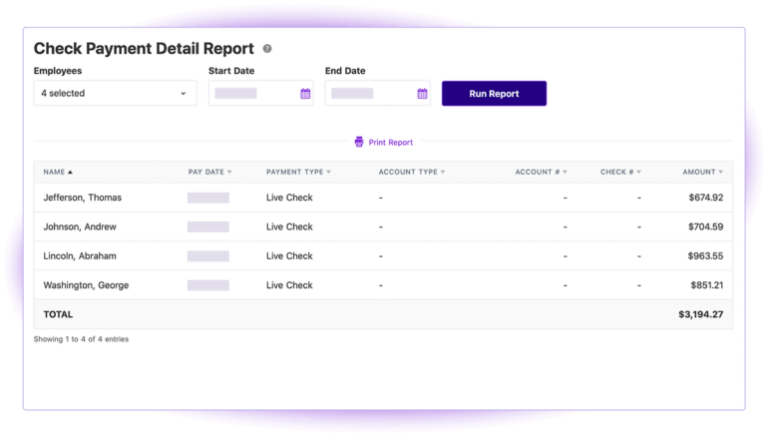

Patriot provides a diverse range of payment options to suit varying payroll needs and preferences. These options include direct deposit, paper checks, pay cards, cash payments, and integration with online payment platforms like PayPal and Venmo. Direct deposit allows for fast and easy transfer of funds directly to employees’ bank accounts, while paper checks provide a tangible option for those without bank accounts. Pay cards work similarly to debit cards, allowing employees to make purchases or withdraw cash, and cash payments are also recorded in the system. Integration with online payment platforms ensures electronic payments are made even for employees without bank accounts.

3. HR Integration

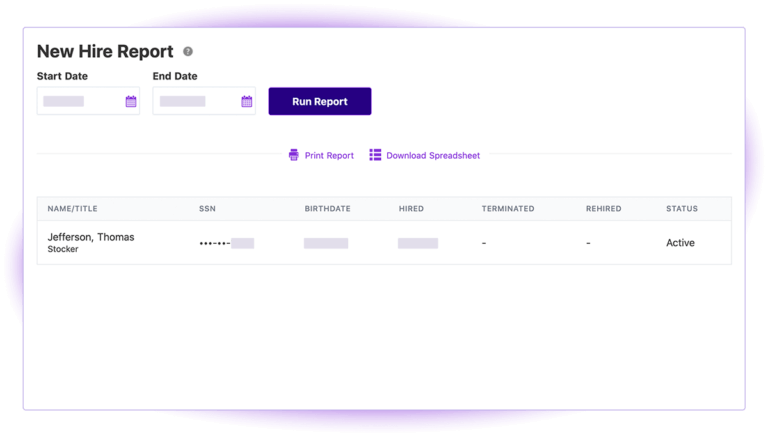

Patriot integrates HR features to simplify HR and payroll processes. Employees can access their pay stubs and other data through a self-service portal. The software also allows for the automated onboarding of new employees. HR can manage time-off requests and track vacation, sick leave, and other time-off types to ensure accurate payroll processing. Further, it syncs employee data from the HR system, eliminating the need for manual data entry and maintaining accuracy.

4. 401(k) integration

Patriot’s software boasts an additional feature of 401(k) integration, which facilitates the smooth management of employee retirement accounts in conjunction with payroll processing. This feature not only streamlines the process for employers but also provides a convenient platform for employees to effortlessly access and manage their retirement plans.

5. Departmentalization

Patriot offers a departmentalization feature that allows businesses to categorize their organization into distinct departments and assign employees to these groups. This feature enables meticulous monitoring of expenses incurred by each division, providing a comprehensive overview of expenditures and tracking the performance of each department with greater precision. It is an effective tool for enhancing control over business operations and enables judicious allocation of funds to teams. Additionally, it assists in identifying areas that require improvement or increased investment and facilitates the strategic allocation of resources for the overall growth and success of the enterprise.

Selected Positive User Feedback:

- “It is a very user-friendly software for both our CPA firm and the client.” – Terri M. (Source G2)

- “I like the software, it is very user friendly and then what I cannot find or understand, the customer service team is very easy to get in touch with and help!” – Abby B. (Source G2)

- “Inputting employees is a smooth process. The customer service is excellent and quick” – Alex D. (Source G2)

- “Accurate Federal Reporting and accurate tallies.” – Charles L. (Source G2)

- “Patriot gives you the most bang for your buck. Full-service payroll is inexpensive and you still get most of the features you would get with a larger, more expensive provider.” – Adrienna G. (Source G2)

- “Patriot has allowed us to monitor all 75+ payrolls for our business client’s payrolls.” – Rachel R. (Source G2)

- “Very easy to use this service and set up process was super legit” – Aoran B. (Source G2)

- “Very easy and user friendly.” – Terri M. (Source Capterra)

- “The live agent chat, the ease of reporting, the ease of payroll processing, all of it really.” – Mary Jo W. (Source Capterra)

- “This software was very easy to use, and as my business grows I am finding the necessary features needed are available to me.” – Noreen E. (Source Capterra)

- “First of all, very affordable. Next, it is very easy to run payroll, the dates are already selected.“ – Geoffrey P. (Source Capterra)

- “User-friendly; allows me to run a payroll on my schedule” – Jo G. (Source Get App)

- “Patriot is very user friendly and cost effective.” – Tammi A. (Source Capterra)

- “You can’t beat the price point for the technology. it’s a solid platform for a small business.” – Karen H. (Source Capterra)

- “I love how I can set it up for a client, and show them briefly how to run their own payroll.” – KriSTan B. (Source Capterra)

Selected Negative User Feedback:

- “My biggest pet peeve is the inflexibility of making tax adjustments.” – Kristan B. (Source Capterra)

- “The reports can be confusing” – Craig B. (Source Capterra)

- “I wish they doesn’t have errors in tax filing. This cause problems for us.” – Sneha C. (Source Capterra)

- “Pulling reports is not as intuitive as it could be.” – Clair C. (SourceG2)

- “Sometimes it takes a few tries to get where you really need to go.” – Bessie C. (Source Capterra)

- “it does not integrate with Quickbooks requiring us to do manual entries” – Terri M. (Source G2)

- “Setting everything up on the front end is a little tricky.” – Alex D. (Source G2)

- “Difficulty finding reports with ease, at times I have to hunt them down” – D. (Source Capterra)

- “The software itself can be super glitchy. It also has errors while tax calculations.” – Adrianna G. (Source Capterra)

- “It lacks some functions of larger systems, but it works great for 90% of companies.” – Michael V. (Source G2)

- “Their reports are somewhat limited and the ability to capture history for changes is non-existent.” – Karen H. (Source G2)

- “It takes 5 business days to get the payroll done.” – Karen F. (Source Capterra)

- “Not having an app for employees to download.” – Samantha S. (Source Capterra)

- “Direct deposit is not intuitive and causes problems. It lacks some features.” – Claire C. (Source G2)

- “Sometimes the link between the software and bank and credit accounts will disconnect.” – Jared C. (Source G2)

What are Patriot’s Ratings from Other Reviews?

(As of December 2023)

- Capterra: 4.8/5

- G2: 4.8/5

- Get App: 4.8/5

- Software Advice: 5/5

What’s My Final Verdict On Patriot?

Patriot is a comprehensive cloud-based payroll and HR software.

With features such as tax calculations, direct deposit, and employee self-service portals, Patriot offers all the standard payroll features you need. Whether you prefer phone, email, or live chat, their customer support team is always on standby to help you out. The software also provides unique features such as time off accruals, net-to-gross payroll tools, HR integration, and contractor payroll. And one thing that stands out to me is it integrates seamlessly with other Patriot Software solutions like Patriot Time and Patriot HR to offer a comprehensive HRM suite.

However, I must say that the absence of a mobile app is a major disadvantage for businesses seeking payroll information on the go. Along with the limited customization, the reporting feature is confusing and lacks complexity. Additionally, Patriot has fewer integrations with other business tools, making it challenging for businesses to connect multiple systems.

To conclude, I believe Patriot is a user-friendly cloud-based payroll software with unique features like time off accruals and net-to-gross payroll tools; nevertheless, its limitations such as the absence of a mobile app need to be weighed by companies before they make a final decision.